Welcome to Global M&A Associates in Zurich

We are a Zurich-based service boutique specializing in domestic and international company sales, acquisitions, and business model scaling.

Our services:

- Company sales in Switzerland and abroad

- Company acquisitions and the handling of search mandates for strategically suitable takeover candidates

- Development, financing and implementation of national and international growth strategies

Interviews with the founders of Global M&A Associates

Business Succession: What kind of a problem do I need to get in touch with you?

What are the the opportunities and risks when it comes to acquisitions?

How to grow internationally

Client References

Sandro Gerber, internationally active CEO and Board member

"Marc Wallach and Dr. Thomas W. Schrepfer are and have been repeatedly active for us. All M&A and advisory mandates were handled to our absolute satisfaction.

I can recommend Global M&A Associates for all kinds of corporate finance activities."

Lorenz Eymann, CEO and shareholder of Translingua Ltd. in Zurich

"Marc Wallach saw us through the acquisition of Translingua AG with the utmost competence and reliability. Due to his commitment, the transfer of the business was conducted to the complete satisfaction of all parties involved. We benefited greatly from his long experience and personal network.

In the period from 2016 to 2019, Marc Wallach shaped our strategic direction for four years as Chairman of the Board."

François Randin, CEO and shareholder of Green Motion SA

„Dr. Thomas W. Schrepfer has supported Green Motion through several financing rounds over many years with great success. In addition, he was crucial in setting up the strategic positioning of the company and also helped us to select local and global strategic partners. He has always been the trusted advisor of our management, board and shareholders. His contributions had a considerable impact on Green Motion’s success story.

Dr. Thomas W. Schrepfer is now the strategy consultant to the management and Board of Directors.“

Thomas Schärer, CEO and owner of Opera AG

„Dr. Thomas W. Schrepfer was extremely competent and reliable in assisting us in the takeover of Opera AG, a leading provider of event technology. Thanks to his experience and expertise, we were able to find a financing solution that met the needs of all parties involved to their complete satisfaction.

Dr. Thomas W. Schrepfer continues to advise our company on all corporate finance issues.“

Alberto Meyer, seller of Translingua AG in Zurich

„I founded Translingua AG in 1975 as one of the first professional translation agencies. Today Translingua AG is a market leader in high quality translations. When I sold the company, Marc Wallach represented the buyers. He acted as a highly competent, fair and persistent lead negotiator for the opposite party.

Due to Marc Wallach my life’s work has been placed in the hands of diligent new owners who will continue the business successfully.“

Award as one of the TOP 5 M&A firms in Switzerland

COVER STORY

Mergers and acquisitions (M&A) offer companies opportunities for rapid growth, increased profitability and strategic advantage.

To help companies meet these challenges, Global M&A Associates GmbH develops tailor-made M&A, growth and financing concepts.

The company's core competencies are corporate sales and succession planning, growth through strategic acquisitions and international scaling through mergers and strategic partnerships.

We are pleased and proud to have been named one of the TOP 5 M&A firms in Switzerland in 2023 because of our client-focused and rigorous approach.

Committed to quality

Our network includes over 1,500 contacts to interested entrepreneurs, investors and corporations worldwide who own and are looking for SME portfolios.

Our successes are the result of careful buyer analysis and personal contacts with Owners, Chairman and CEOs.

We acquire new clients through referrals from satisfied clients. Accordingly, we are committed to the highest qualitative and ethical standards.

In addition, we are active in established networks and enjoy a high profile and impeccable reputation.

Selected Reference Projects and Transactions

Landmark transaction in the Swiss electromobility infrastructure market

evpass SA operates the largest public charging station network for electric vehicles in Switzerland with 2,998 charging points. On February 23, 2023, the existing shareholders of evpass SA (Green Motion SA, FMV SA and AEW Energie AG) sold all shares of evpass SA to Shell.

With this acquisition, Shell further expands its position for EV charging solutions and gives customers access to the largest charging station network in Switzerland. Globally, Shell has a target of over 500,000 charging points by 2025 and over 2.5 million by 2030.

The Board of Directors of evpass SA is convinced that Shell, as a global energy player, is the best investor to further accelerate the growth of evpass SA and thus effectively support the shift towards climate-friendly mobility.

Global M&A Associates GmbH has been exclusively advising evpass’ founders since the launch of evpass in 2016 and the Board of Directors of evpass SA and its management on corporate finance matters since evpass became legally independent in 2018. In the trade sale to Shell, GMA Associates GmbH identified and selected potential strategic partners and led the corresponding negotiations on behalf of the Board of Directors of evpass SA.

Key Lead Advisor Activities of Global M&A Associates GmbH:

- 2018: Spin-off of evpass and creation of evpass SA followed by two capital increases with national energy companies FMV SA and AEW Energie AG.

- 2021: Sale of Green Motion SA, the founder of evpass SA, to EATON.

- 2020-2023: Accompanied the Board of Directors and the management of evpass SA in the strategic positioning of the company, the identification and evaluation of potential strategic partners and the preparation of the trade sale.

- 2023: Trade sale of evpass SA to Shell. Shell is listed on the London Stock Exchange.

Succession plan successfully completed

Kierzek AG is the leading electrical planning company in the canton of Thurgau.

"Kreuzlingen-based Kierzek AG is being taken over by EKT Holding AG, based in Arbon, Thurgau. Kierzek AG will keep its headquarters and all jobs in Kreuzlingen.". Source: EKT media release, April 14, 2022.

Global M&A Associates LLC advised EKT as buyer in this transaction on an exclusive basis.

From SME to global technology leader and subsequent trade sale to a global corporation

Global M&A Associates LLC has exclusively advised Green Motion's main shareholders and its management on corporate finance transactions and supported them in strategy and financing issues for many years.

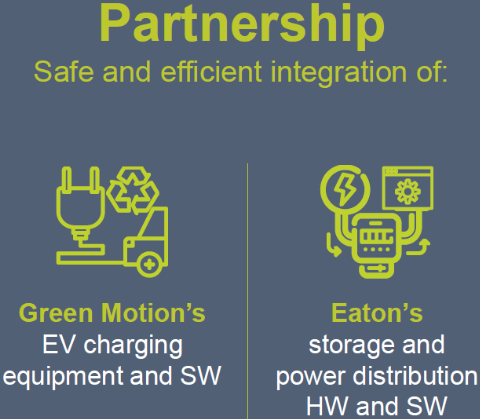

Eaton Corporation, a multinational energy management company, announced the acquisition of Green Motion S.A. on March 22, 2021. Green Motion is a leading developer and manufacturer of hardware and software solutions for electric vehicle charging.

Milestones:

- 2021 Trade Sale to Eaton Corporation. EATON is listed on the New York Stock Exchange (NYSE).

- 2020 Brokering and closing of a strategic collaboration and pan-European sales cooperation with EATON.

- 2018 - 2021 Support for shareholders and management to prepare Green Motion for a trade sale in terms of strategic positioning and organizational structure, as well as search for and evaluation of potential strategic partners.

- 2018 Spin-off and establishment of subsidiary evpass S.A. followed by two capital increases with national energy companies (FMV SA and AEW Energie AG).

- 2016 Capital increase. Zhongding Europe GmbH, Germany. Subsidiary of the Chinese Zhongding Group, which is listed on the stock exchange in Shenzhen China.

- 2012 Capital increase. CROSINVEST, investment boutique, Germany.

Succession plan successfully completed

"The Zurich-based company Energie Pool Schweiz AG ("EPS"), which is one of the leading providers of digitalization in the Swiss energy sector, was successfully transferred to EKT Holding AG, based in Arbon, Thurgau, as part of the succession plan for the managing director and main shareholder. Energie Pool Schweiz AG will continue to operate as an independent company." Source: EKT March 17, 2021

Global M&A Associates LLC advised EKT as buyer in this transaction on an exclusive basis.

Establishment of a strategic partnership with a global corporation

On the initiative of Global M&A Associates LLC, EATON has decided to establish this strategic partnership with Green Motion.

EATON's approach and all negotiations were conducted exclusively by Global M&A Associates LLC, on behalf of Green Motion.

" Eaton has partnered with Green Motion to deliver turnkey EV charging infrastructure (EVCI) solutions for all types of buildings." Source: EATON Investor Conference, March 1, 2021.

Spin-off into a separate company, partial sale, and growth financing

evpass SA operates the largest and fastest growing network of public charging stations for electric vehicles in Switzerland.

As part of a spin-off, the evpass business unit was transferred from Green Motion SA to an independent company (evpass SA).

Subsequently, a part of the shares of evpass SA was sold to FMV SA and AEW Energie AG and simultaneously the further financing of the expansion of the public charging station network was secured with the same parties.

Global M&A Associates LLC exclusively advised Green Motion SA and evpass SA on these corporate finance projects.

Company Sale to a New Management

Translingua AG, founded in 1975, is the Swiss market leader for quality translations.

Successful sale in the context of company succession to prudently acting new owners..

Global M&A Associates LLC accompanied this transaction on an exclusive basis.

Share capital increase and brokerage of strategic partnerships

Green Motion is the Swiss market leader for charging stations for electric vehicles.

In order to finance its growth, the company has carried out several capital increase rounds and has entered into several strategic partnerships with a view to geographic expansion. The strategic partners and investors come from Europe and China.

Global M&A Associates LLC advises Green Motion SA on the development of its growth and corporate finance strategies and the execution of related transactions on an exclusive basis.

Spin-off, procuring of strategic partnerships and financing

Lindis Biotech GmbH is a Munich-based biotechnology company that develops and markets antibodies for the treatment of cancer.

The company has entered into a strategic partnership with a Chinese company to develop the Asian market. In addition to licensing rights, the companies also granted reciprocal participations and founded a joint venture company.

Furthermore, the marketing and legal enforcement of the IP portfolio of the company were financed.

These transactions were handled by Global M&A Associates LLC in cooperation with our partner company IMI Consulting GmbH as co-advisor on an exclusive basis.

Company Acquisition (MBI)

Opera AG is a leading supplier of event technology in light, image and sound.

Global M&A Associates LLC advised the buyer exclusively on the acquisition and financing of this management buy-in.

Share capital increase and procuring of strategic partnerships

YUKKALab is a technology leader in financial market sentiment analysis.

Global M&A Associates LLC supported the Berlin-based company in market development in Switzerland, in strategic growth and financing issues and in the capital increase.

Company Acquisition (MBO)

ABO Storage Distribution is a leading Swiss provider of Data Centric Solutions.

Global M&A Associates LLC advised the Managing Director of ABO Storage Distribution exclusively on the acquisition and financing of this management buy-out.

The Founders

Following highly successful collaboration over the last few years, PMIC Advisors Group LLC and SalesLex Ltd. decided to form Global M&A Associates LLC together. Global M&A Associates LLC stands for quality and client oriented value creation. We and our partners cooperate on a project to project basis. This selective approach enables us to provide our clients with teams whose members are the best fit with their needs.

Dr. Thomas W. Schrepfer is a founding partner of Global M&A Associates LLC and Managing Partner of PMIC Advisors Group GmbH. He holds law degrees from the University of Berne (Dr. iur., M Law) and Harvard Law School (LL.M.) as well as business degrees from the Rotman School of Management, Toronto (MBA) and the University of St. Gallen (EMBA-HSG). He has received prestigious awards such as the Professor-Walther-Hug Prize and the Roger N. Wolff Prize as well as a scholarship from the Swiss National Fund for his academic and scientific work in law and business. From 1985 onwards, he worked for several years as a commercial lawyer specializing in international transactions, M&A and corporate and tax law, and became a senior partner in a Zurich law firm. He also served as an executive chairman and board member on the Board of Directors of pharmaceutical, IT, medical device and leisure industry companies. In 1999 he founded a medical device company and took it to the cutting edge of technology in the diabetes field. He then managed a niche consultancy providing services in such areas as strategy, leadership, business development, restructuring and M&A. From 2011 onwards he was a partner at Remaco, a leading Swiss company for small and medium sized transactions. He expanded Remaco’s clientele geographically and sectorally. Since 2014, he has been the managing partner at PMIC Advisors Group Ltd. He has successfully established strategic partnerships with companies located in Asia and Northern America for several clients located in the German speaking part of Europe.

Dr. Thomas W. Schrepfer is a founding partner of Global M&A Associates LLC and Managing Partner of PMIC Advisors Group GmbH. He holds law degrees from the University of Berne (Dr. iur., M Law) and Harvard Law School (LL.M.) as well as business degrees from the Rotman School of Management, Toronto (MBA) and the University of St. Gallen (EMBA-HSG). He has received prestigious awards such as the Professor-Walther-Hug Prize and the Roger N. Wolff Prize as well as a scholarship from the Swiss National Fund for his academic and scientific work in law and business. From 1985 onwards, he worked for several years as a commercial lawyer specializing in international transactions, M&A and corporate and tax law, and became a senior partner in a Zurich law firm. He also served as an executive chairman and board member on the Board of Directors of pharmaceutical, IT, medical device and leisure industry companies. In 1999 he founded a medical device company and took it to the cutting edge of technology in the diabetes field. He then managed a niche consultancy providing services in such areas as strategy, leadership, business development, restructuring and M&A. From 2011 onwards he was a partner at Remaco, a leading Swiss company for small and medium sized transactions. He expanded Remaco’s clientele geographically and sectorally. Since 2014, he has been the managing partner at PMIC Advisors Group Ltd. He has successfully established strategic partnerships with companies located in Asia and Northern America for several clients located in the German speaking part of Europe.

His main focus is on buy side and sell side, MBO and MBI transactions including financing, strategic partnerships, M&A strategy, corporate financing including growth financing, and succession planning.

Email: thomas.schrepfer@gma-associates.com

Marc Wallach is a founding partner of Global M&A Associates LLC and owner of SalesLex Ltd. In addition to his technical apprenticeship, engineering studies at a technical college, and Executive Master’s degree at the Zurich University of Applied Sciences, he also holds an Executive MBA in general management from the University of St. Gallen. He is an expert in the planning and execution of growth projects, growth financing, and M&A transactions. He has many years of C-level management experience and is distinguished by his excellence in turnaround situations and his crisis management and negotiation skills. His practical experience in the machine industry, insurance, and banking enable him to produce feasible solutions to complex problems quickly. Along with proven M&A competence, he has more than 20 years’ experience in project management and the implementation of external growth strategies in the mechanical engineering and financial industries. He is an entrepreneur and seasoned board member. His main industry focus is on finance and services, commerce, ICT and technology.

Marc Wallach is a founding partner of Global M&A Associates LLC and owner of SalesLex Ltd. In addition to his technical apprenticeship, engineering studies at a technical college, and Executive Master’s degree at the Zurich University of Applied Sciences, he also holds an Executive MBA in general management from the University of St. Gallen. He is an expert in the planning and execution of growth projects, growth financing, and M&A transactions. He has many years of C-level management experience and is distinguished by his excellence in turnaround situations and his crisis management and negotiation skills. His practical experience in the machine industry, insurance, and banking enable him to produce feasible solutions to complex problems quickly. Along with proven M&A competence, he has more than 20 years’ experience in project management and the implementation of external growth strategies in the mechanical engineering and financial industries. He is an entrepreneur and seasoned board member. His main industry focus is on finance and services, commerce, ICT and technology.

His main functional expertise lies in succession planning, the execution of M & A transactions (buy side and sell side), classic and growth financing, the acquisition of takeover targets, the acquisition of investors, and the optimization of our clients’ market activities.

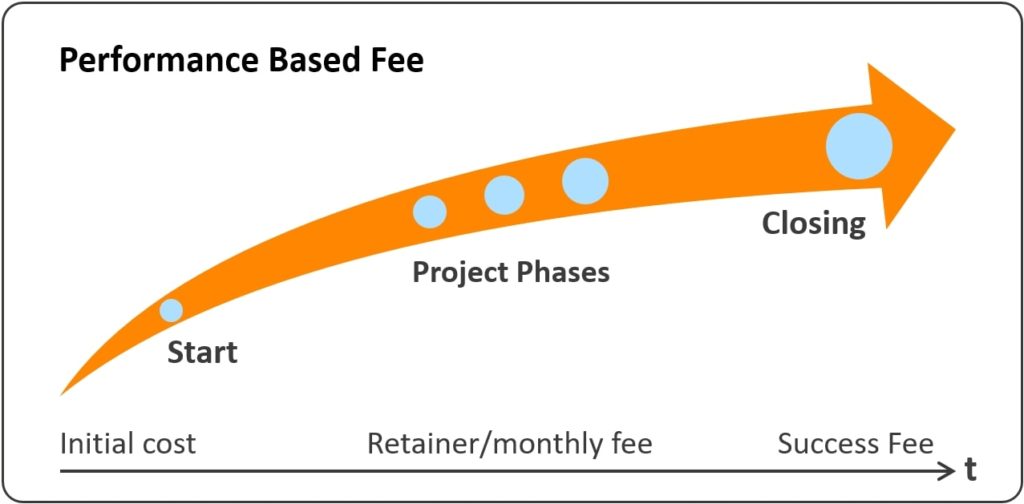

Performance Based Fees

The combination of fixed and performance based fees highlights our mutual commitment to do whatever it takes to achieve our shared goal.

The combination of fixed and performance based fees highlights our mutual commitment to do whatever it takes to achieve our shared goal.

The predominant part of our compensation depends on successful completion of the envisaged transaction.