Our Core Competences

Solutions for local and global success

- Buy side and sell side advisory

- Credit and growth financing

- Procuring strategic partnerships for domestic and international success

We accompany our clients throughout the entire life cycle of their enterprises and develop appropriate M&A, growth, and financing strategies. This approach leverages their ability to obtain the best possible financing terms, acquisitions, strategic partners or buyers.

Few enterprises develop in a straight line. From incorporation or purchase to divestment or succession planning, challenges will arise over and over again. They have to be addressed with careful consideration, strategic savvy and financial strength.

Few enterprises develop in a straight line. From incorporation or purchase to divestment or succession planning, challenges will arise over and over again. They have to be addressed with careful consideration, strategic savvy and financial strength.

We represent our clients in negotiations with sellers, buyers, strategic partners, banks and investors, taking a goal oriented and persistence approach.

Acquisition, Incorporation, MBO and MBI Transactions

The far-reaching decision to purchase or start up a company has to be planned and implemented with all due care. It is of the utmost importance to define the scope of the investment and the amount of money needed to reach your goals.

The way a company is financed is likely to have a significant impact on its future success. The design of the purchase and participation agreements, the definition of liabilities, and the terms of the agreements among shareholders are all vital in deciding how a company will perform and how it will grow in value.

We have represented a large number of entrepreneurs in acquisitions. We have always succeeded in creating win-win situations while securing our client’s interests. In most of these transactions, we managed and coordinated the due diligence process as well. We have successfully supported management teams in many management buy-outs and buy-ins.

We have represented a large number of entrepreneurs in acquisitions. We have always succeeded in creating win-win situations while securing our client’s interests. In most of these transactions, we managed and coordinated the due diligence process as well. We have successfully supported management teams in many management buy-outs and buy-ins.

As a discreet M&A boutique, we secure the indispensable confidentiality of the transaction process. We also advise on the financial terms and support the financing process.

Business and Growth Financing

We help companies and entrepreneurs to secure the funds they need to finance the everyday running of their business as well as growth projects and acquisitions.

In practice, many companies prefer to finance investment and growth projects with their own funds. In some situations, this can be a wise approach. However, in others it may restrict opportunities for fast growth or timely strategic acquisitions.

We use the following forms of financing:

- share capital increase

- private equity

- private placement of loans, bonds, and convertible loans or bonds

- public placement of bonds or convertible bonds (for amounts exceeding CHF 20 million)

- leasing and factoring

- mezzanine capital

Successful growth financing calls for diligent planning and preparation, systematic investor searches, objective decision making criteria and results oriented negotiations.

As an independent consultancy we will see you through the preparation and implementation of your financing project.

Growth Generation: Procuring Strategic Partnerships and Acquisitions

Many medium-sized companies struggle to face up to global competition because of sub-critical mass and limited purchasing power on the one hand, and difficulty in dealing with unfamiliar business cultures and legal systems on the other.

In many cases, strategic partnerships or acquisitions are the only way for a company to stand its ground or strengthen its market position in the international arena.

In many cases, strategic partnerships or acquisitions are the only way for a company to stand its ground or strengthen its market position in the international arena.

We provide our clients with search and selection services when they are seeking strategic partners, licensees or acquisition targets, and conduct the negotiations from the very beginning through to successful completion.

Succession Planning for Business Owners

For many business owners, succession planning means parting with their life’s work. They want continuity in the future running of the business and job security for their employees. Transferring ownership is an extremely emotional act which many seasoned entrepreneurs find difficult to tackle.

To accompany business owners effectively in their succession planning therefore requires not only professional but also strong social skills. In this delicate process, we see ourselves as sparring partners, supporting our clients with the required degree of empathy and sensitivity.

To accompany business owners effectively in their succession planning therefore requires not only professional but also strong social skills. In this delicate process, we see ourselves as sparring partners, supporting our clients with the required degree of empathy and sensitivity.

If there is no family member willing or able to take over the business, we help our clients to seek an external buyer. Very often, a takeover by a member of the management team (MBO), an external manager (MBI) or a competitor are the most obvious solutions. However, sometimes the situation may also demand a sale to a financial investor (private equity).

In close cooperation with our client, we strive to find the best fitting solution and to make that solution work.

Our professional and social skills enable us to offer the full band width of required services ourselves or through our well established network. We are also pleased to collaborate with our clients’ trusted long term legal, accounting, tax and real estate advisors.

Selling a Company as a Transaction

After a period of success, the question of a company sale, asset sale or exit very often arises for an entrepreneur or investor. Timely execution and maximization of the selling price are essential in such transactions.

We have represented many owners, both individuals and groups, in selling all or part of their businesses.

We have represented many owners, both individuals and groups, in selling all or part of their businesses.

It takes experience and creative approaches to optimize the results.

We undertake a comprehensive search to identify the most suitable buyers, taking our clients’ specific interests into account. Bids are negotiated in a structured process to secure comparability and optimize results.

We deploy interdisciplinary teams (due diligence specialists, lawyers, tax advisors, etc.) in order to achieve timely solutions that satisfy all criteria.

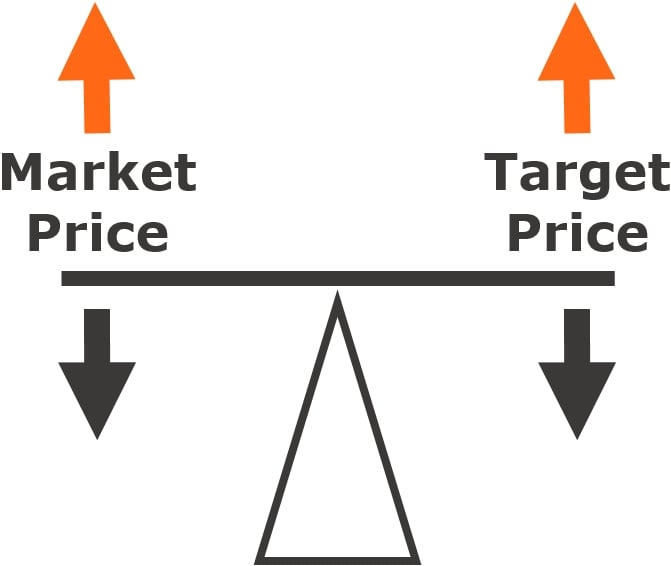

We Optimize and Maximize Valuations and Transaction Prices for our Clients

We optimize the value of your company as perceived by potential buyers or investors and support you in the search for them.

Approach:

Approach:

- Based on an in-depth analysis of your company and the buyer and investor market, we prepare your company optimally for the transaction and establish an approximate valuation.

- Supported by these findings, we develop the strategic positioning and set up the story book.

- The search for buyers or investors will be conducted with the utmost focus and discretion.

This consistent approach ensures discreet and successful handling of your assignment.

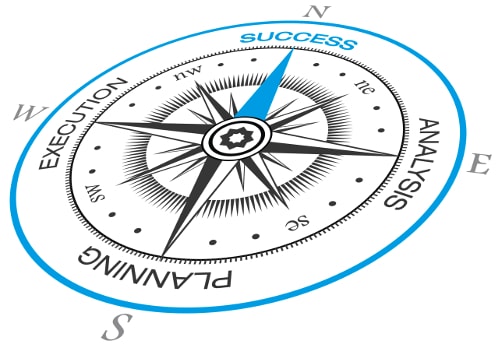

Success Based on Structure

A successful transaction is based on structured processes that are coordinated with the client and fine tuned to the specific assignment.

Key issues from the point of view of buyers and investors are:

Key issues from the point of view of buyers and investors are:

- The management

- The environment, market opportunity, and positioning

- The technology

- The price, risk/return ratio and share ownership ratio

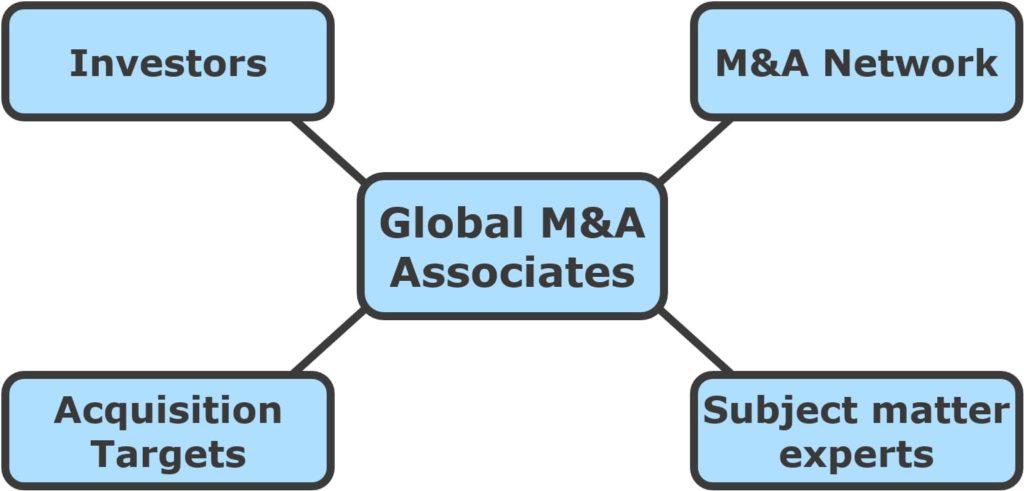

Our Global Network = Your Basis for Success

Our network keeps us in constant contact with potential buyers, suitable investors, interesting acquisition targets, and prospective strategic partners.

We have access to experienced highly qualified experts for all questions that might arise in the context of M&A transactions.

We have access to experienced highly qualified experts for all questions that might arise in the context of M&A transactions.

Your advantages:

- competent, experienced contacts

- project based teams

- cost efficient services

M&A Strategies

We design successful M&A strategies and close deals successfully.

Are you planning a comprehensive M&A approach for your company? We not only support companies in the execution of M&A transactions, but also advise them on the best way to set up and implement a promising M&A strategy.

The following questions have to be addressed:

- How can M&A accelerate the realization of your strategic business plan or make it more successful?

- What kind of financial constraints exist?

- Which companies are potential targets?

- What are the initial estimates of acquisition cost? What return could be produced?

- How do the potential targets rank in term of impact on the business and the feasibility of purchase?

The answers enable us to identify external growth opportunities that can make a substantial contribution to the success of your strategic business plan.

Simultaneously, this approach delivers a clear picture of the financial range of potential transactions and helps to ensure a target-oriented use of the available resources.

Crucial factors for success are a sharp cut M&A strategy tailored to your needs, diligent planning, a structured and coordinated course of action, and consistent communication.

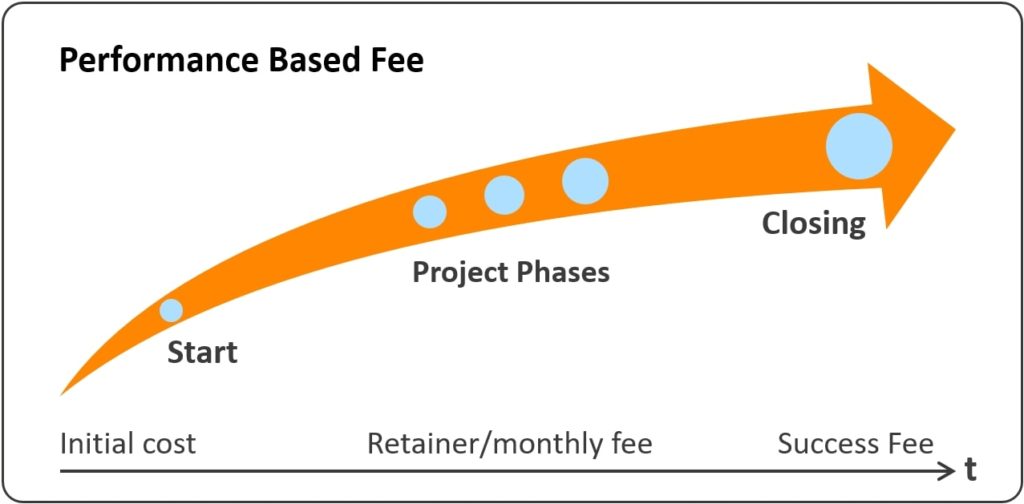

Performance Based Fees

The combination of fixed and performance based fees highlights our mutual commitment to do whatever it takes to achieve our shared goal.

The combination of fixed and performance based fees highlights our mutual commitment to do whatever it takes to achieve our shared goal.

The predominant part of our compensation depends on successful completion of the envisaged transaction.